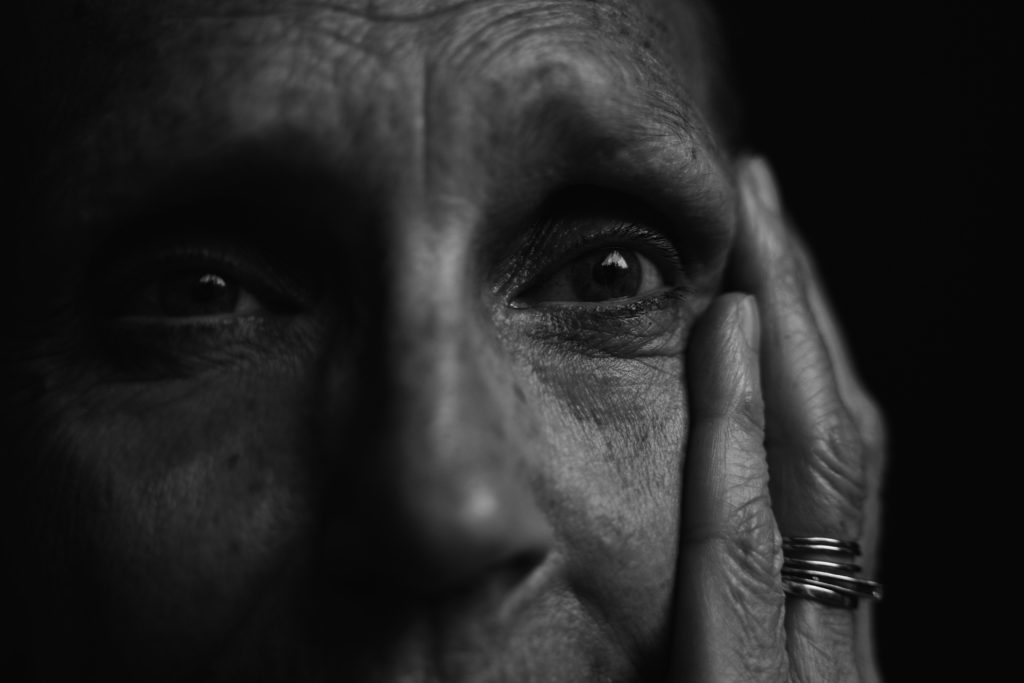

We are here to help you and your loved ones remain safe.

Elder abuse, neglect, and exploitation can be physical, emotional, financial, sexual, or self-inflicted. It can happen anywhere, and the abuser can be a loved one, family member, friend, neighbor, paid caregiver, or stranger.

Each year, hundreds of thousands of older persons are abused, neglected, and exploited. At Vintage, we work to ensure that older adults who have been abused are supported and protected, and we have a zero-tolerance policy for any kind of abuse.

We are here to help provide support and education to prevent abuse, exploitation, and neglect.

Financial exploitation is a common occurrence. It happens when a person misuses or takes the assets of a vulnerable adult for their benefit. Exploitation frequently occurs without the explicit knowledge or consent of an older or disabled adult, depriving the person of certain assets.

Assets can be taken via forms of deception, pretenses, coercion, harassment, duress, and threats.

Here are some types of Financial Exploitation of Older Adults to be wary of:

If you witness a life-threatening situation involving a loved one or adult with disabilities, dial 911.

Contact your local law enforcement agency and Adult Protective Services agency any time you observe or suspect the following:

Please note that certain professionals must report elder abuse, caretaker neglect, and exploitation of at-risk elders (an at-risk elder is any person 70 years of age or older). If you are a mandatory reporter and you witness or become aware that an at-risk elder has been or is at imminent risk for mistreatment, you must report to law enforcement within 24 hours.

To report suspected elder abuse, contact your local law enforcement agency and the Adult Protective Services (APS) agency in the county where the person resides:

If you want to learn more about APS, watch this informational video from our friends at El Paso County.